TraTax | SST: New Taxable Services and Taxable Goods

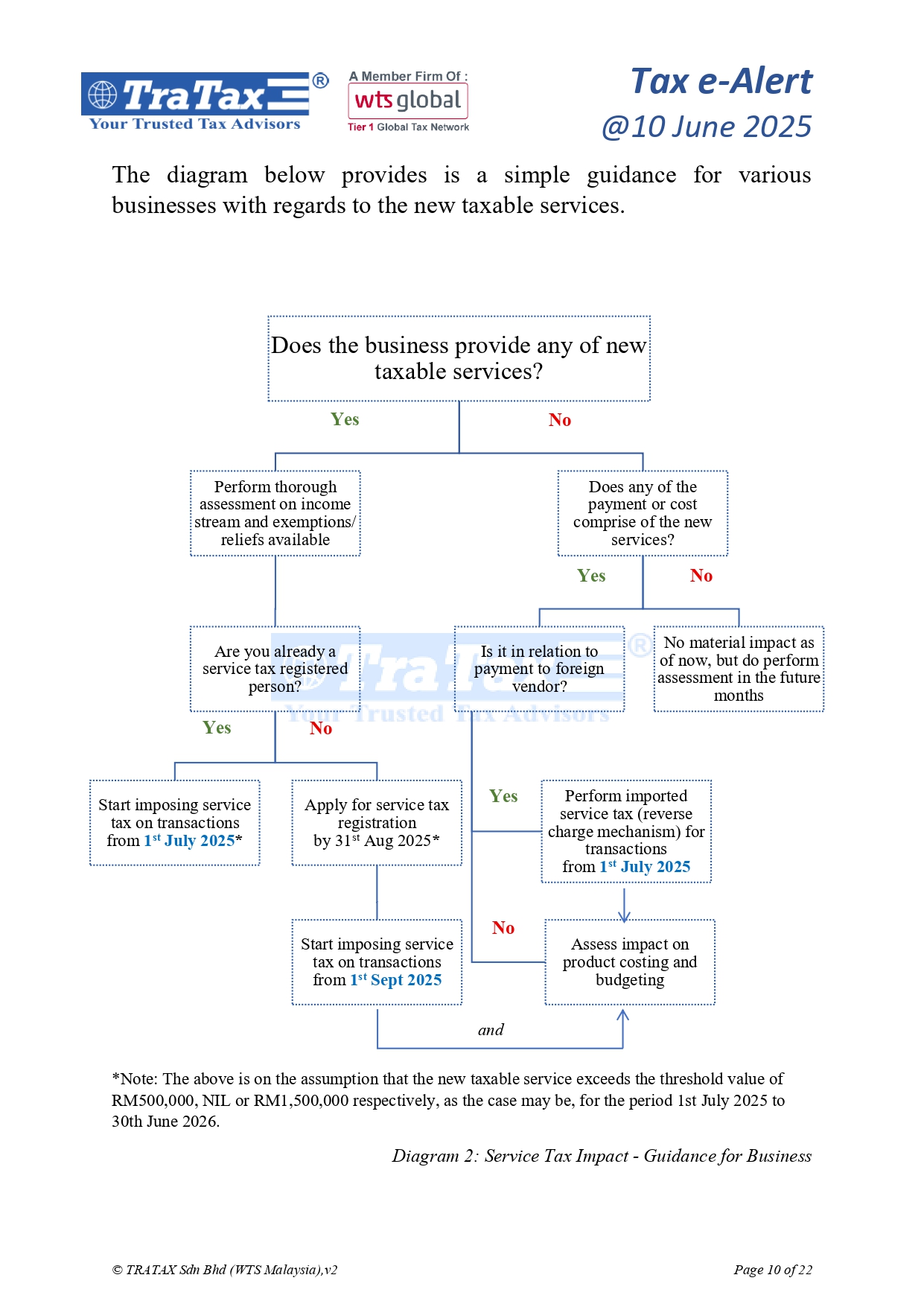

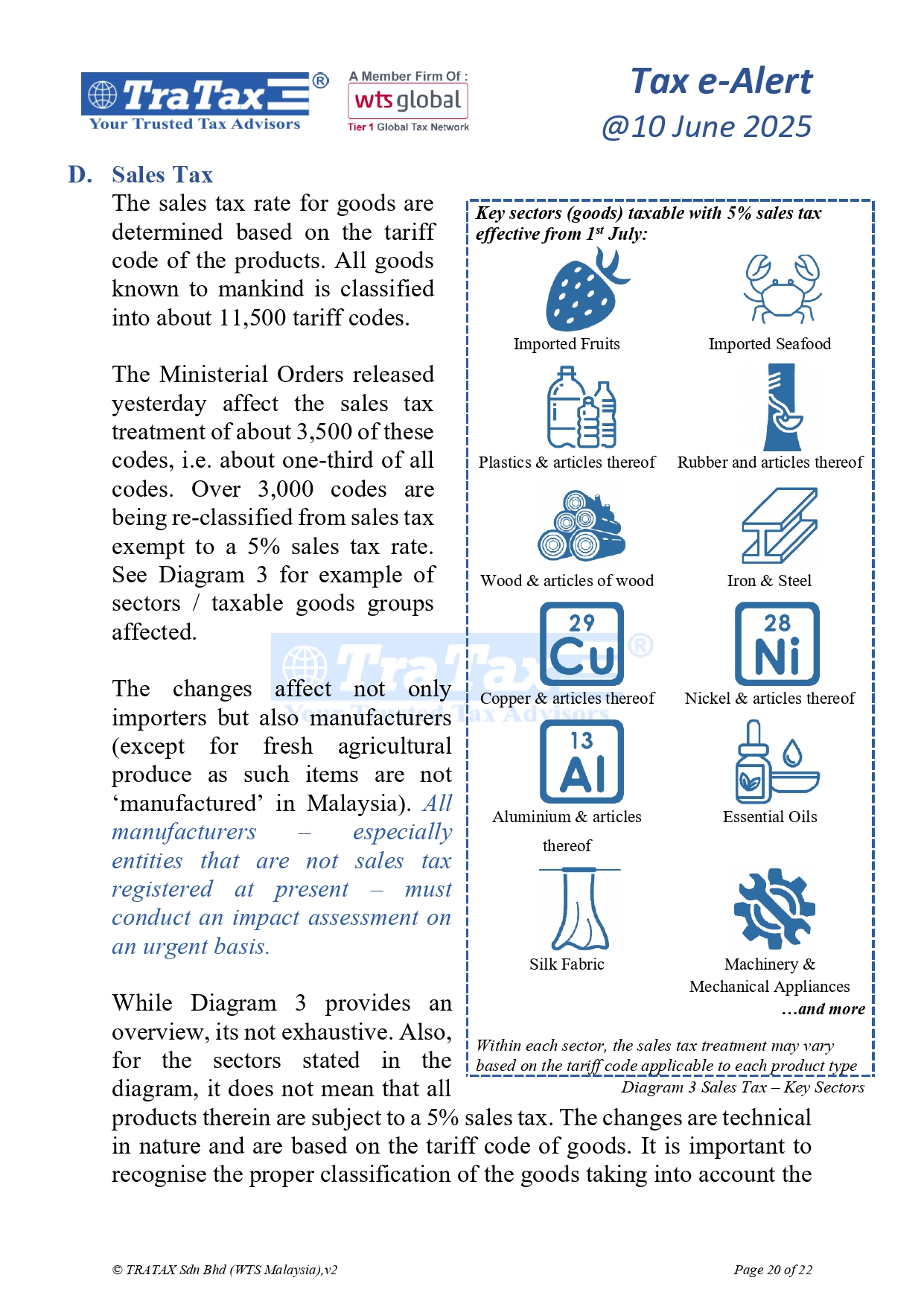

Over 3,000 categories of goods – as per tariff codes – that were exempt from sales tax would be subjected to a sales tax of 5% from 1st July 2025. For manufacturers who are currently not sales tax registered, the effect of this change could be a requirement to register for sales tax by 31st August and start charging sales tax from 1st September.

Importers and sales tax registered manufacturers would see the impact more immediately from 1st July.

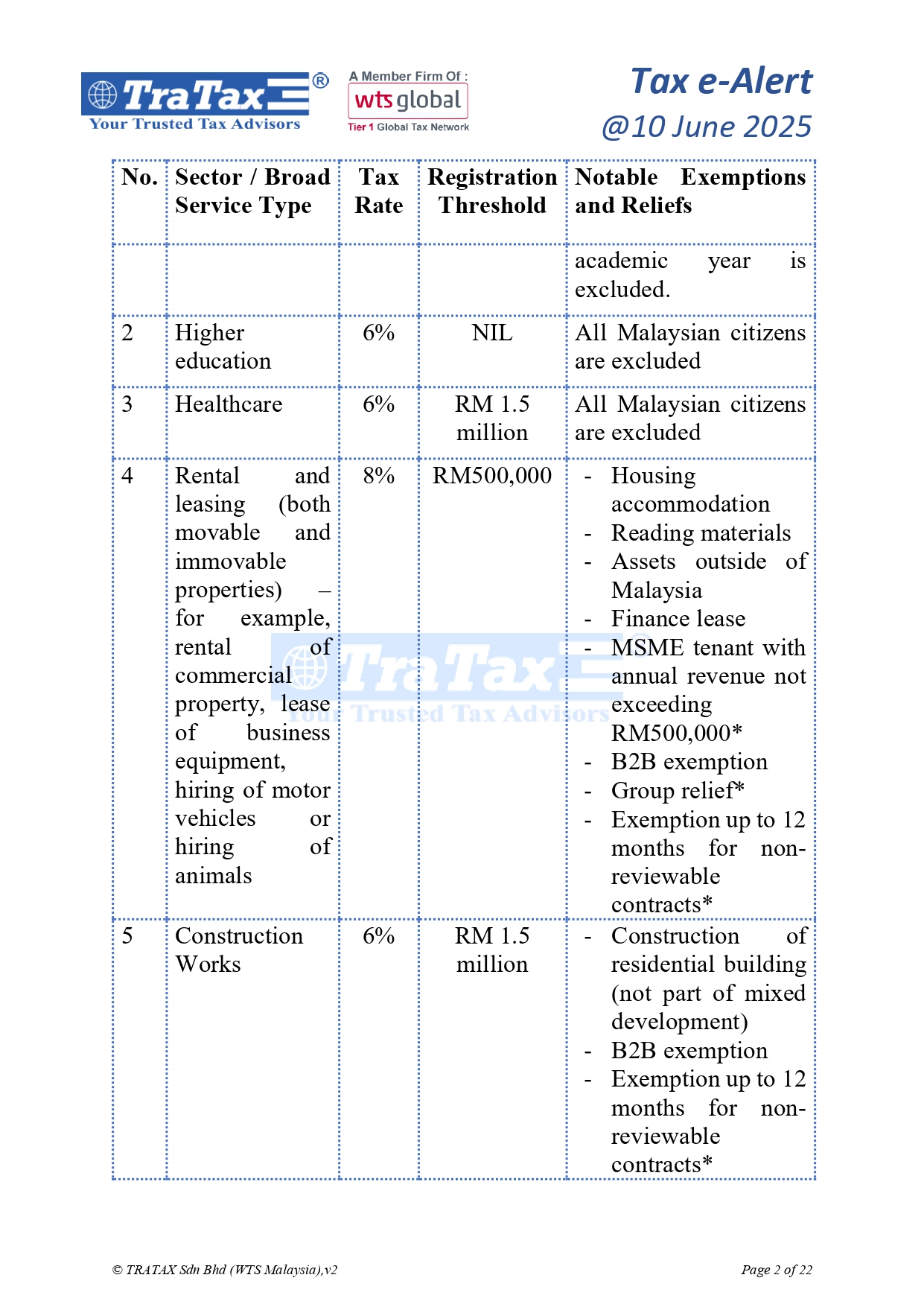

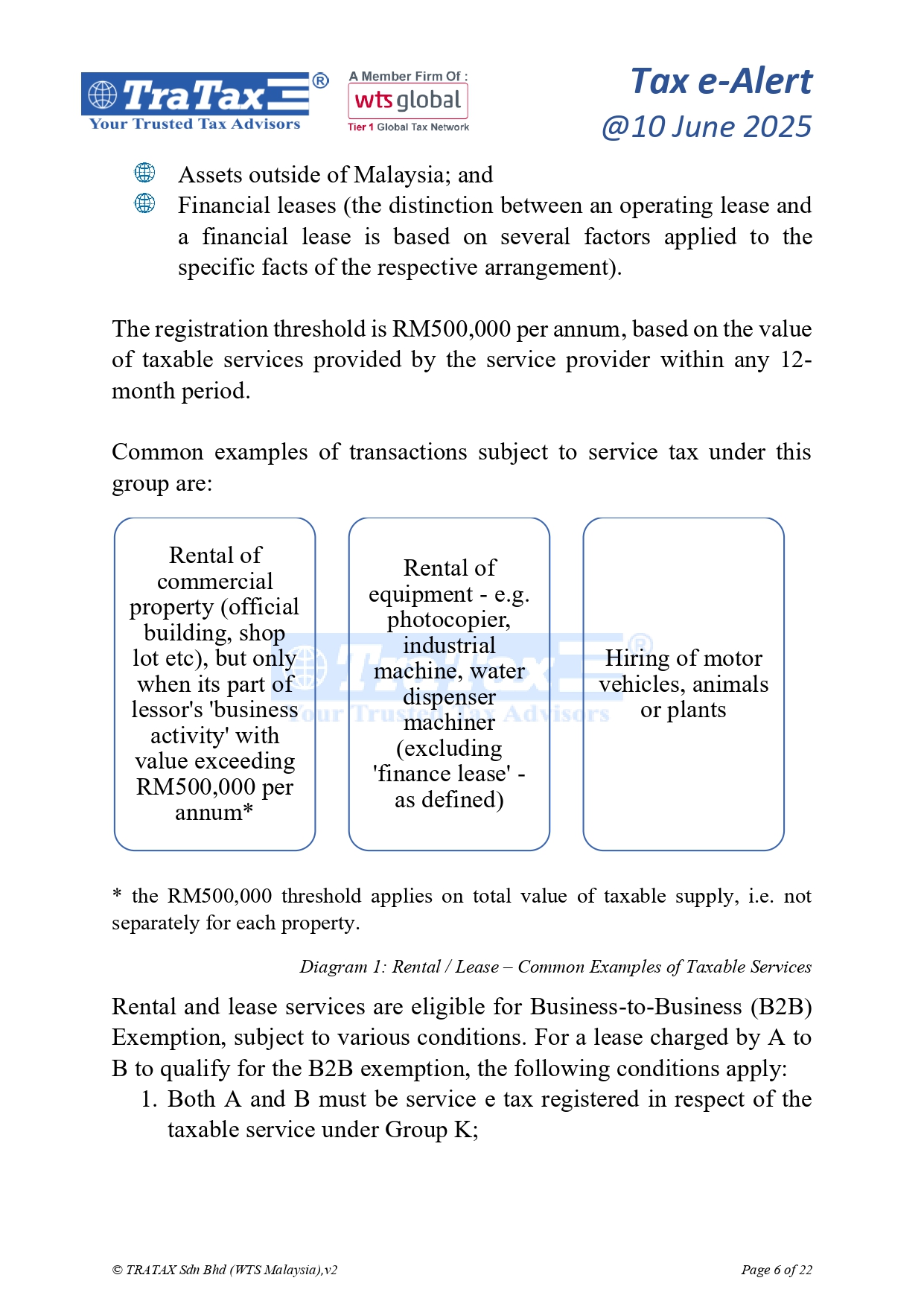

Concurrently, the scope of service tax is expanded to include sectors such as education, healthcare, financial services, construction and leasing/rental of tangible assets (including rental of commercial properties).

For more details, read our 22-page analysis on the key changes and its implications.

For details, join our forum on 19th June or email corp@tratax.my if you need consulting support on any tax, transfer pricing or SST matters.