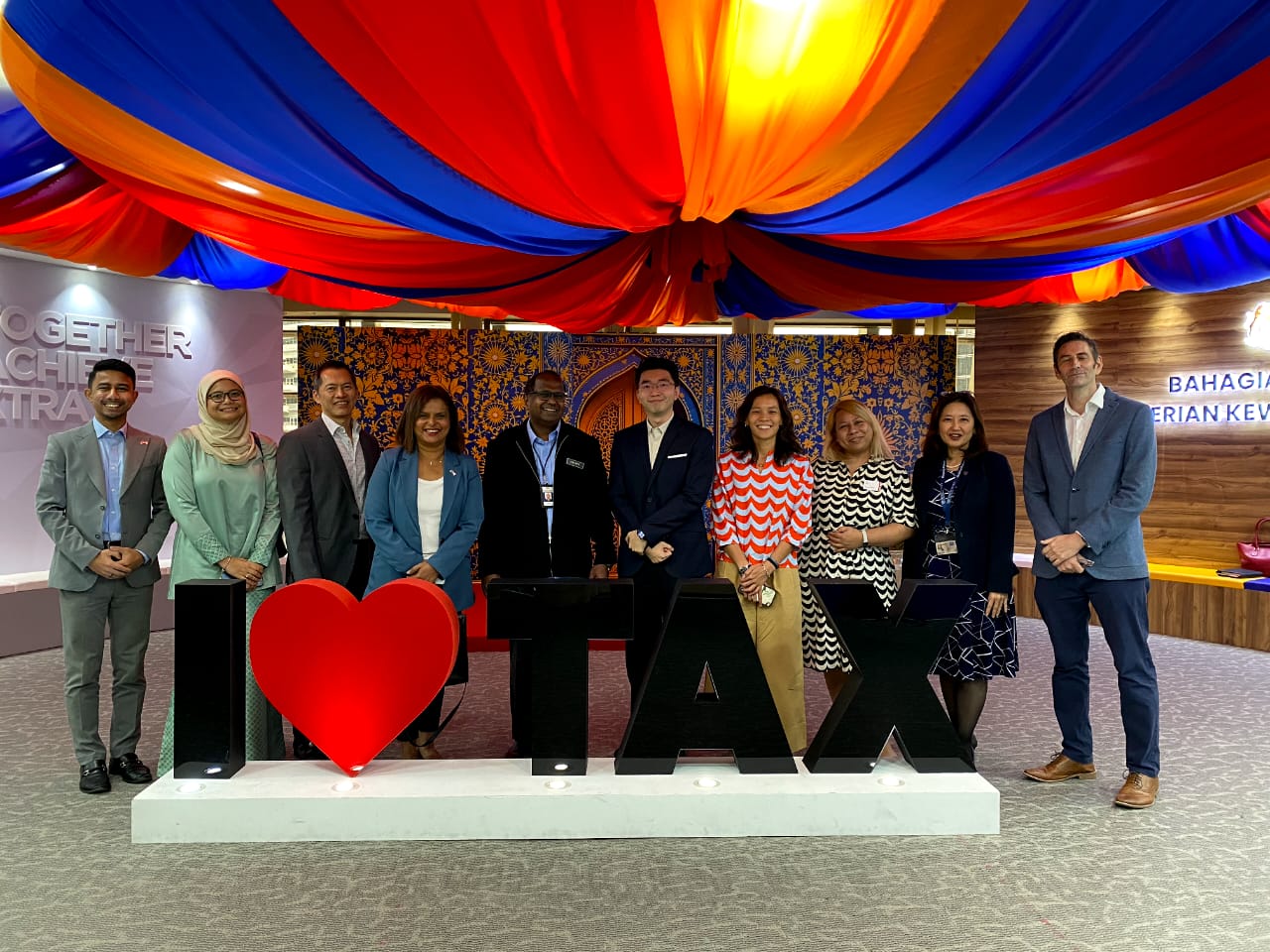

BMCC Engagement Session with Ministry of Finance on SST Expansion Issue on Private Education Sector

On 2 July 2025, we organised an engagement session with the Ministry of Finance (MOF) and the Royal Malaysian Customs Department to seek clarification and gain a deeper understanding of the recently announced expansion of the Sales and Service Tax (SST) to the private education sector. The session was attended by representatives from BMCC member companies in the education industry, reflecting the sector’s collective interest in understanding the implications of the policy change on private education institutions.

The meeting was chaired by John Patrick Antonysamy, Undersecretary of the Tax Division at the Ministry of Finance. Also present were key officials from the Ministry of Finance: Md Taufiq Md Ralip, Deputy Undersecretary of the Tax Division, and Mohd Fadzlee Malik, Head of Section at the Tax Division. Representing the Royal Malaysian Customs Department was Ahmad Syukri Idris, Senior Assistant Director of the Inland Tax Division and Head of the SST Taskforce on Education.

During the session, BMCC members had the opportunity to raise their concerns and questions regarding the SST expansion, including potential impacts on tuition fees, administrative requirements, and the overall cost of delivering private education services. The open dialogue allowed for constructive exchanges and helped both parties gain valuable insights into the challenges faced by the private education sector.

The BMCC extended its sincere appreciation to the Ministry of Finance and the Royal Malaysian Customs Department for their time, openness, and support in facilitating this important engagement, which underscores the Chamber’s commitment to advocating on behalf of its members and ensuring clarity on regulatory developments affecting the business community.